Small Businesses’ and Entrepreneurs’ Perceptions of Single-Payer Health Care

As America’s health care debate rages on, one key group is especially divided. Business owners across the country are wrestling with the potential benefits and consequences of a single-payer health care system – and reaching contrasting conclusions.

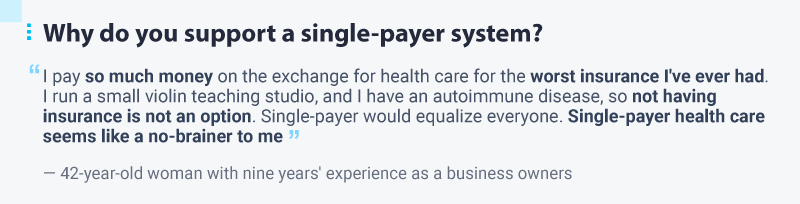

At one end of the spectrum, some business advocacy groups have adamantly opposed “Medicare for All” and similar proposals. Conversely, recent research indicates strong support for a single-payer system among business owners who see employee health benefits as a major financial burden. Which facts, fears, and ideological factors inform these divergent perspectives? We decided to find out.

We surveyed 543 business owners and self-employed entrepreneurs, analyzing their enthusiasm and anxiety about a single-payer health care system. Our results reveal mixed – yet strong – feelings within this key segment of the American economy. To find out how business owners across the political spectrum really feel about single-payer health care, keep reading.

Defining the Debate

Before plunging ahead with our results, it may be helpful to define some of the terms at the heart of this debate. Phrases such as “Medicare for All” and “single-payer health care” are often applied to different policy proposals, and much ambiguity remains as to how these programs might be implemented. For our project, however, we used the following definitions of single-payer and employee-sponsored health care plans.

Currently, a majority of adults aged 19 to 64 get their medical insurance through employer-sponsored plans. Americans aged 65 and older qualify for Medicare, the federal government’s health insurance plan for older adults, and nearly 60 million people currently receive Medicare benefits.

Essentially, single-payer plans propose that the federal government provide health insurance to all Americans, replacing employer-based insurance with a national program much like Medicare. The “single payer” of these proposals is the government: Neither patients nor insurance companies would pay directly for care.

Support Comparisons, Cost Expectations

Employee health benefits represent a major expense for most businesses. Currently, employers typically cover the majority of workers’ premiums, spending thousands of dollars per employee per year. So, did our business owner respondents embrace single-payer health care, anticipating a reduction in their operating costs? After we weighted our data to reflect the political allegiances of the American public, our results suggested strong single-payer support.

Seventy percent of business owners either supported or strongly supported a single-payer health care system. This finding resonates with levels of support for such a system among the wider public and suggests the nation’s openness to such a sweeping change. Although business owners who identified as Democrats overwhelmingly supported single-payer health care, 37% of Republicans did so, as well.

Interestingly, most respondents also supported employer-sponsored health care, indicating a significant degree of ideological flexibility. Some political candidates have proposed a blending of these systems, advocating for the creation of a “public option” alongside existing private insurance. Conversely, “Medicare for All” purists argue that private insurance should be eliminated altogether.

Many business owners also opposed single-payer health care, however, perhaps due to concerns that their costs would actually increase. Indeed, a majority of Republican business owners felt a single-payer system would drive their costs higher or much higher. These worries relate to how single-payer plans would be funded: Some proposals call for a payroll tax on businesses. Most Democrat business owners, by contrast, felt a single-payer plan would lower their costs overall.

Perceived Pros and Cons

To explore the calculus behind business owners’ support or opposition to single-payer health care, we queried them on a range of potential drawbacks and advantages. Our findings indicated that the majority believed single-payer health care’s upsides outweighed its liabilities.

Among our respondents, the most common perceived benefit was a reduction in expenses. This advantage may seem increasingly attractive, as employer health care costs are projected to rise in the years ahead. Fifty percent also felt single-payer health care would reduce the time and resources devoted to employee insurance issues, a view that was especially common among owners of newer businesses. Especially for lean startups, the administrative headaches of managing employee health plans can feel like a major hindrance.

However, many business owners also perceived some potential downsides of a single-payer system. The most common concern was an increased tax for businesses to fund a single-payer program. Another frequent objection was that a single-payer system would unfairly disadvantage businesses with more than 50 employees that are required to contribute to Medicare’s funding. Businesses with fewer employees do not, but their workers would still get coverage under a single-payer plan.

Overall, however, roughly three-quarters of business owners said the potential advantages of a single-payer plan outweighed its possible drawbacks. This finding indicates that single-payer supporters are aware of the challenges such a plan might pose but are still enthusiastic.

Reallocating Health Care Expenses

If business owners were to see their expenses fall significantly under a single-payer system, how would they reinvest that newly available pool of money? We posed that question to our respondents, excluding those who anticipated no savings and those who said they would not reinvest (8% in total). The results are quite compelling, especially for workers eager for a pay raise.

Fifty-seven percent of respondents said they would use the extra money to increase their employees’ wages. This finding could help allay concerns that a single-payer plan would increase middle-class taxes: If employers increase wages, and families no longer pay premiums, the typical American household would see a considerable net benefit.

Thirty-six percent would transfer the extra money into savings, storing up capital for future opportunities and challenges. A similar percentage said they would put the added cash toward other employee benefits, which could include valuable perks, such as 401(k) matching. Another 35% said they would make capital improvements, investing in new infrastructure or equipment, while 34% said they’d allocate the funds to marketing and advertising.

Additionally, 29% said they’d use their health care savings to hire new employees. This result might help dampen concerns about a single-payer system’s impact on the U.S. employment market. Experts estimate that “Medicare for All” would eliminate millions of jobs in the fields of insurance and health care administration, so the creation of new positions would be welcome.

Party and Plan Preferences

Across the political spectrum, which health care plans and particular candidates do business owners support? Our findings suggest that party affiliation often informs our opinions but does not necessarily govern them.

More than half of respondents identified the single-payer system as their preferred choice for the future of American health care. This view was dominant among Democrats, although many within the party have also voiced reservations about committing to a single-payer health care system.

Interestingly, nearly a quarter of Republican respondents also felt the single-payer system was the best choice for America, while the same percentage favored a public option. These opinions appear to be at odds with the views of Republican legislators, many of who have lambasted increased government involvement in health care. Republican business owners were also most likely to want to stick with the current health care system. Indeed, research suggests that Republicans tend to be more satisfied with their current health care costs than Independents and Democrats.

Whomever each party nominates for the 2020 contest, health care will certainly loom large over their campaigns: 43% of business owners and entrepreneurs said health care policy would be an extremely important component of how they decide to vote.

Employment Options for an Uncertain Future

Our findings reveal a compelling mix of optimism and anxiety: While many business owners believed a single-payer system would provide powerful benefits, many others feared the financial consequences of such a proposal. Although our results suggest most business owners support single-payer health care, a significant minority vehemently opposes this sort of sweeping overhaul.

In truth, many of the hopes and fears apparent in our findings reflect the ambiguous nature of current single-payer proposals. It’s difficult to anticipate how “Medicare for All” might evolve as it proceeds through the legislative process, especially given the contentious political climate and our nation’s upcoming elections. Until a concrete bill can be specifically debated, much uncertainty and controversy will remain.

For professionals, this uncertainty has important implications. While health care benefits are currently part of choosing the perfect gig, a single-payer system would certainly shift that calculus. Thankfully, SimplyHired can help you find a position with excellent benefits in the present – and support you if you need a new opportunity down the road. Check out our job listings today and see how we can help you advance your career.

Methodology

We conducted a survey of 543 Americans. The survey was distributed on Prolific. Using Prolific’s custom screener options, respondents were only able to take the survey if they were currently engaged in entrepreneurship, running their own business, or self-employed in their own incorporated or unincorporated business. Respondents were then asked to answer questions about their opinions of a single-payer health care system.

The survey was conducted from Feb. 10 to 12, 2020.

Fifty percent of our respondents identified as female, 49% identified as male, and 1% identified as a gender not listed on our survey. Respondents ranged in age from 18 to 82, with a mean of 41 and a standard deviation of 12.5.

The data were weighted for the U.S. population by political affiliation according to Gallup.

Limitations

It is possible that with more respondents who were business owners, we may have been able to gain better insight into this demographic. The findings on this page rely on self-reporting and, as such, are susceptible to exaggeration or selective memory.

No statistical testing was performed. The claims listed above are based on means alone and are presented for informational purposes.

Fair Use Statement

If you know a business owner who might be interested in our project, please feel free to share our work with them. In fact, you’re welcome to share this project with anyone who might enjoy it, and we hope it prompts constructive discussions. We do have two simple requests, however. First, please use this content only for noncommercial purposes. Second, please link back to this page whenever you share our work, allowing others to enjoy the full project.