Recent turmoil around immigration policy has created added pressure for talent acquisition professionals to understand the myriad requirements that affect whether job candidates can live and work in the United States.

Recent turmoil around immigration policy has created added pressure for talent acquisition professionals to understand the myriad requirements that affect whether job candidates can live and work in the United States.

International candidates have questions regarding their employment eligibility, and organizations are under increased scrutiny. Last year, penalties for missing, incomplete, or error-ridden I-9s nearly doubled.

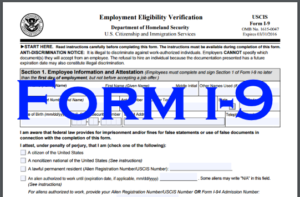

Unfortunately, those requirements are a moving target. The U.S. Citizenship and Immigration Services (USCIS) recently released a new version of Form I-9, the second-such revision in fewer than 12 months. What do corporate recruiters need to know to answer candidates’ questions and protect their companies?

Here’s a rundown of what the new Form I-9 means for you.

About Form I-9

Form I-9 is used to verify employees’ identities, and that they are authorized to work in the U.S. The form requires employees to produce documents that prove their identities and eligibility for employment.

Companies are required to keep a completed Form I-9 for every person they hire to work in the U.S., both citizens and non-citizens, for three years after the date of hire, or one year after employment ends, whichever is later. These records are subject to inspection by ICE.

What are the most important changes?

Employers have until September 17, 2017, to begin using the new version of the Form I-9. Fortunately, most of the changes were minor and clerical.

Here is a high-level summary; you can find complete details in the USCIS announcement:

Revisions to Form I-9 instructions:

- The Office of Special Counsel for Immigration-Related Unfair Employment Practices (OSC) is now called the Immigrant and Employee Rights Section (IER).

○ The words “the end of” have been removed from the phrase “the first day of employment.”

Revisions to the list of acceptable documents:

- Consular Report of Birth Abroad (Form FS-240) has been added to List C.

- All certifications of report of birth issued by the Department of State have been combined into selection C #2 in List C.

- All List C documents have been renumbered, except for the Social Security card, which remains at the top of the list.

- Along with the new form, USCIS released a revised Handbook for Employers: Guidance for Completing Form I-9 (M-274), which is intended to be easy for users to navigate.

What should you do?

The good news for recruiters is that most of the changes are relatively minor — there aren’t sweeping changes to what documents are acceptable or who is eligible to work in the U.S.

The good news for recruiters is that most of the changes are relatively minor — there aren’t sweeping changes to what documents are acceptable or who is eligible to work in the U.S.

However, if not properly implemented, the new Form I-9 represents a risk for your organization.

According to an industry attorney at Jackson Lewis, 60 to 80 percent of paper I-9s are either missing, incomplete, or have errors. The number of Immigration and Customs Enforcement (ICE) business site inspections and I-9 audits has increased dramatically in the past decade. And with the new administration’s focus on immigration compliance, more can be expected.

One way to mitigate a company’s risk is to ensure use of the latest Form I-9 for all new hires ahead of the September deadline. Beyond ensuring new hires provide proper documentation, it is essential that all teams that recruit and onboard employees understand the form basics.

Ultimately, a regular internal Form I-9 audit is best practice to achieve the following goals:

- Optimize – Companies are held accountable for errors on all I-9s in their database, regardless of whether an I-9 has already exceeded retention requirements. As you’re auditing your Forms I-9, purge those that have met retention requirements.

- Prioritize – Sort and prioritize your issues to help focus resources on the most critical issues or those easily corrected. The Departments of Justice and Homeland Security offered joint guidance to help employers perform an internal audit along with proper procedures for correcting errors and omissions.

- Digitize – Implementing an electronic I-9 management system can eliminate much of the confusion about acceptable documentation, improving the onboarding experience for new hires while also helping to mitigate risk. Electronic audit and remediation solutions can also efficiently and thoroughly review your entire I-9 archive for issues.

Why you need to pay close attention

In today’s global marketplace, understanding the requirements that affect candidates’ eligibility to live and work in the U.S. is an essential function for corporate recruiters and talent acquisition professionals.

Although the recently released changes to Form I-9 were relatively small, any update tends to cause confusion among both candidates and recruiters – and this latest round of revisions is unlikely to be the last

Authors

Angela Lockman

Angela Lockman is responsible for the Tax and Compliance services product management team at Equifax Workforce Solutions. Under her management are market leading products for I-9 Management, Unemployment Claims Management, the Affordable Care Act, Tax Credits and Incentives, Tax Form Management and the Compliance Center onboarding portal. Angela received her Certified Economic Developer (CEcD) designation in 1994. Angela serves on the executive board of the National Employment Opportunities Network (NEON) and is also a member of the State and Local Tax Study Group of the South Carolina Department of Revenue. She speaks frequently on employer compliance topics at regional and national conferences. You can follow Angela on Twitter @LockmanAngela, and connect with her on LinkedIn.

Recruit Smarter

Weekly news and industry insights delivered straight to your inbox.