Market Trends for Cleaning and Security Contractors

Service contractors in the cleaning and security industries can gain a competitive advantage in crafting successful business plans by understanding market trends and research, economic outlooks and industry-specific predictions. This is especially true as there are ongoing debates among economists and researchers about the possibility of another recession.

For cleaning and security employers, accurate data is particularly important because of relevant industry challenges, such as increased demands from clients. However, by understanding the market trends related to facilities management and comprehending the broader macroeconomic picture, it is possible to stay one step ahead of the competition during this economic climate.

Inflation

The U.S. Bureau of Labor Statistics recently reported the inflation rate was 3.4% in December 2023, based on the 12-month percentage change from the year prior. Their report also stated that the consumer price index increased 0.3%, a rise from the 3.1% annual inflation reported in November, and 0.2% more than the 3.2% economists expected.

Even though the inflation rate remains higher than the Federal Reserve’s target of 2.0%, it has significantly retreated from the 40-year high of 9.1% in June 2022. That said, a 3.4% rate does mean inflation is starting to normalize. As prices begin to stabilize, the labor market continues to create more jobs than there are people.

Inflation also has an impact on the perception of wage increases. Despite wages and salaries increasing nationally by another 4.5% in 2023, when inflation is factored in the increase felt like only 0.8%. Employees are simply not feeling the increase.

The persistence of a still-elevated inflation rate helps explain why many Americans are dissatisfied with the economy, despite steady economic growth, ongoing wage increases and low unemployment.

Interest rates

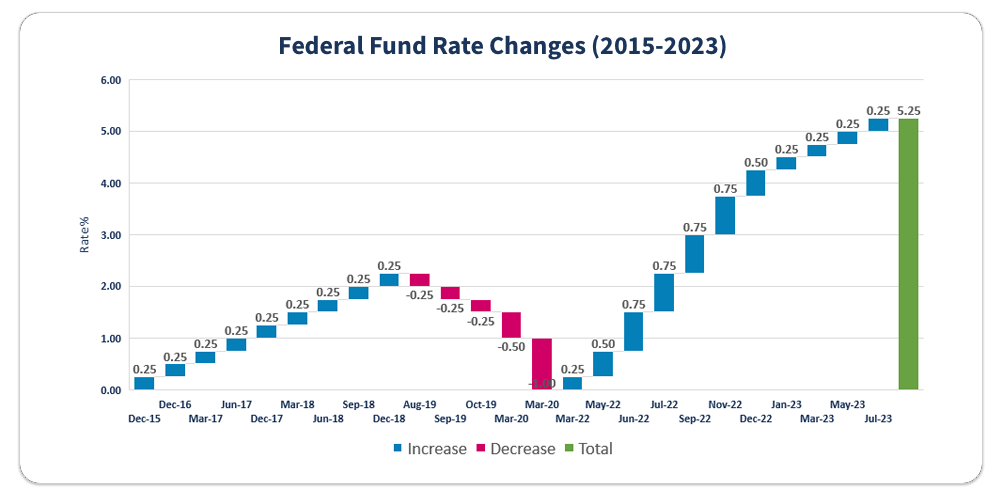

To combat inflation, the Federal Reserve has leveraged interest rates to engineer a ‘soft landing’ and avoid a full recession. Changes to interest rates play an important role in shaping the economic landscape. Seemingly small fluctuations in interest rates can have a major impact on the cost of borrowing, investment decisions and overall business operations.

Rising interest rates can negatively impact a business, specifically its ability to service debt, when a company incurs rising costs without an increase in revenue to offset additional money being spent. High-interest debt can drain working capital that could otherwise be used to manage direct costs and fund growth.

For most of 2023, the cost of capital exceeded 5%, the highest it’s been in 23 years. That said, interest rates are reportedly holding somewhat steady, increasing by about 1% between January and July 2023. However, the Federal Reserve recently predicted decreases in 2024, setting the table for multiple interest rate cuts this year.

Mergers and Acquisitions

Capital waiting to be deployed into the private equity market, or so-called dry powder, rose 8% to a record $2.59 trillion globally in Dec. 2023, according to S&P Global Market Intelligence. Loosely stated, that means $2.59 trillion in idle cash is available amongst private investment partnerships that buy and manage companies before selling them.

A major factor in the accumulation of dry powder is the hesitancy to deploy capital in the current macroeconomic environment. Measured from January to November 2023, total deal value dropped 35.6% to $437.85 billion from $679.48 billion between the same 11-month period one year ago, reported S&P Global Market Intelligence researchers.

Insights from both the BSCAI’s M&A Watch Report and Robert Perry’s 2023 white paper on the U.S. Contract Security Market both identified mergers and acquisitions activity starting to return in Q3 2023 after a decline since 2019 and projected more deal volume in coming quarters.

Building occupancy

As a result of the COVID-19 pandemic, many companies reconsidered their requirements for reporting to work. Hybrid and remote work models quickly became the norm. And while that offers a host of benefits, such as increased productivity, better work-life balance for employees and choosing from a wider talent pool – office vacancy rates have substantially increased.

Researchers reported that before 2020, the quarterly vacancy rate was around 12 percent but as the pandemic unfolded, it climbed to above 15 percent. In the first quarter of 2023, about 16.1% of office space across the country was vacant. In some of the major U.S. markets, vacancies reached up to 30%.

Industry professionals are stating that the security and cleaning industries are experiencing challenges while attempting to scale down or change previous contracts, which are not always flexible. Multi-use tenants are also posing new demands, such as more efficient cleaning and guarding models, occupancy credits and flexible service schedules.

Economic ripples due to commercial building loan defaults are also negatively impacting contractors. The inability to collect office rent increases the stress on regional banks and reduces tax funding for public transport relied on by many service employees.

Sustainability

Customers and some government agencies are setting sustainability targets and expect suppliers to support environmental, social and governance (ESG) investing. Some examples of ESG investing include energy consumption and efficiency, carbon footprint, waste management, air and water pollution and natural resource depletion.

Cleaning and security contractors can support ESG investing through green cleaning, electric vehicles, fair compensation, supply change management, diversity and inclusion and data security.

In January 2023, the European Union finalized its Corporate Sustainability Reporting Directive, which will require 50,000 companies to file annual reports on their business risks and opportunities related to social and environmental issues, and how their operations affect people and the environment.

Technology

Artificial intelligence breakthroughs could have a huge impact on the global economy. Researchers estimate that AI tools could drive a $7 trillion increase in GDP and lift productivity growth by 1.5 percentage points over a 10-year period, according to a Goldman Sachs report.

Workflow changes triggered by AI advances could expose roughly 300 million full-time jobs. Although this means that approximately two-thirds of U.S. occupations could be impacted by AI, the changes in automated work may only partially impact different job roles by complementing the work currently performed by people, rather than substituting AI for all of those workers.

Examples of how AI could impact service industries include: eliminating hiring biases, generating content for policies, procedures and marketing campaigns, deploying resources more efficiently and accelerating workflows or increasing capabilities within workflows.

Researchers believe that administrative personnel and attorneys would experience most of the impact, while physically demanding or outdoor workers would experience less of an effect. However, advancements in technology that initially displaces workers generally creates employment opportunities in the future.

Moving forward

Better planning for your next business moves and managing business expectations for 2024 involves understanding national market trends. Inflation and interest rates, building occupancy and technology are just a few.

To continue learning more about the job market and employment trends, review our eBook titled: Data Report: Labor Trends. Then speak with one of our specialists to learn more about how combining that knowledge with industry-specific technology can help your business survive and thrive during this challenging period.