As 2024 begins, the fourth quarter (Q4) Employment Situation Jobs Reports, compiled by the Bureau of Labor Statistics (BLS), provide vital insights into the trajectory of the job market. These reports shed light on trends in various industries, average wages, and in-demand sectors for hiring, presenting a detailed overview of the employment situation.

Beyond reflecting the state of the U.S. economy, these reports play a significant role in shaping policy decisions, impacting financial markets, and offering crucial information about the job market and economic trends to the public.

General Market Trend Breakdown

The U.S. national unemployment landscape showed considerable stability in the final quarter of 2023, maintaining a consistent average unemployment rate of 3.7%, identical to the rate observed in the third quarter. Detailed quarterly analysis indicates that October experienced a slightly higher unemployment rate of 3.8%, followed by a return to the 3.7% rate in both November and December. Throughout the entirety of 2023, the unemployment rate in the U.S. displayed minimal fluctuation, ranging between 3.4% and 3.8%.

In terms of nonfarm payroll employment, December 2023 marked a significant increase with the addition of 216,000 jobs, a substantial rise compared to the 105,000 jobs added in October and 173,000 in November. The average monthly job addition for the fourth quarter was 164,000, resulting in a total of 494,000 new positions. However, this decreased from the nearly 850,000 new jobs seen in the third quarter. By the end of 2023, the total nonfarm payroll in the United States had reached 156.23 million, an increase of 2.6 million employees from December 2022.

A notable aspect of the current economic indicators is the consistent increase in average hourly earnings. There was a minor rise from $34.00 in October to $34.27 in December. This trend has been ongoing for several years, with the exception of a brief deviation during the early months of the COVID-19 pandemic in 2020. The current rate of average hourly earnings is now the highest ever recorded in U.S. history.

In conclusion, while there have been slight variations in unemployment rates, the broader U.S. employment landscape, especially in nonfarm payroll employment and hourly earnings, shows promising trends. These indicators suggest a growing and resilient economy, marked by steady job creation and rising wages, offering a positive outlook for the U.S. economic situation.

Industry-Focused Digest

In their monthly analyses, the Bureau of Labor Statistics (BLS) focuses on industries that have demonstrated significant job growth, offering insights into the specific areas within these industries where employment is increasing. Reviewing the reports from the fourth quarter, there are key industry highlights that stand out and are particularly noteworthy.

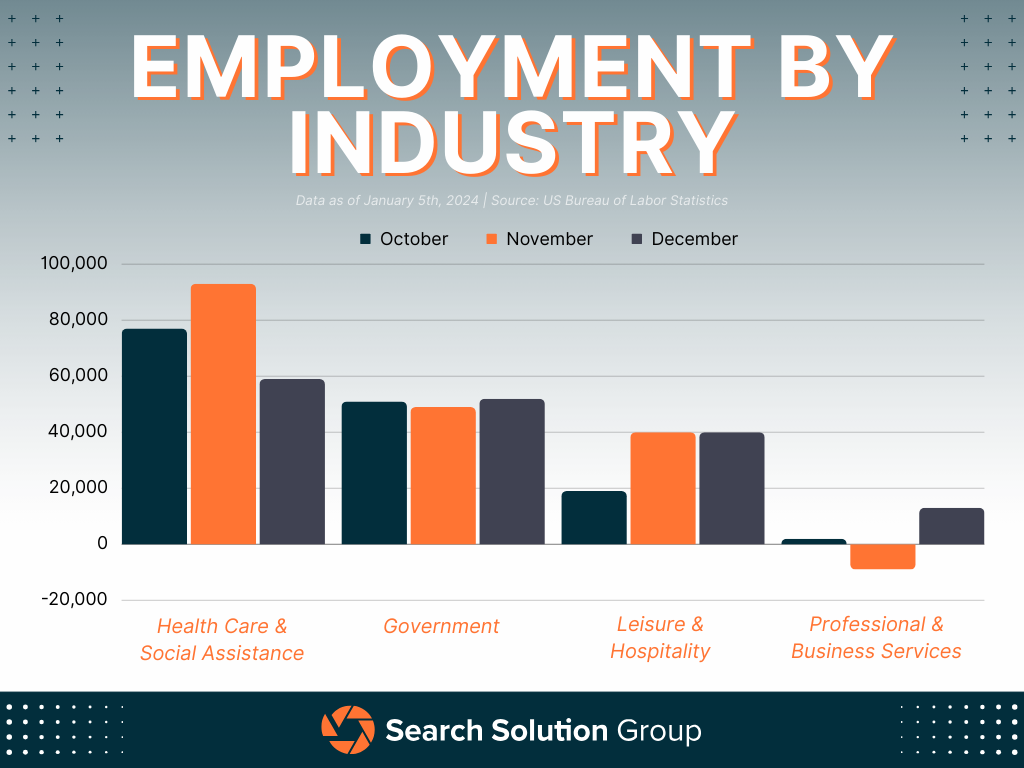

Health Care & Social Assistance continued its trend from the last quarter, adding the most jobs in the fourth quarter, with a total of 229,000 new jobs. This industry, which the BLS groups together in its calculations, averaged about 76,000 new jobs per month in the third quarter. Notably, Health Care saw a spike in job additions in November, while Social Assistance peaked in December. The monthly breakdown shows that October contributed over 77,000 jobs, November over 93,000, and December just over 59,000. Despite some fluctuations, this industry consistently led in job creation for another quarter.

The Government sector also showed strong job additions, with 152,000 jobs in the third quarter, averaging just over 50,000 jobs per month. After seasonal adjustments, the monthly figures were quite consistent: October saw 51,000 new jobs, November 49,000, and December closed the quarter with 50,000. Although it remains second in terms of job additions, the government sector saw a notable decrease in job creation compared to the previous quarter, aligning more closely with the second quarter of 2023, which saw 145,000 new jobs.

A significant shift occurred in the Leisure and Hospitality industry from the third to the fourth quarter. While the industry added 174,000 jobs in Q3, the fourth quarter saw the creation of only 99,000 jobs. This sector experienced a gradual increase throughout the quarter: October added 19,000 jobs, and both November and December each added 40,000 jobs.

However, the Professional and Business Services industry presented a concerning trend in Q4. Mirroring its performance in Q3, it added only a combined total of 6,000 jobs, a stark contrast to the 130,000 jobs added in Q2 of 2023. The industry showed negligible growth throughout the quarter and even experienced a loss of 9,000 jobs in November. In comparison, October saw an addition of 2,000 jobs, and December ended the year with an increase of 13,000 jobs.

The fourth quarter industry analysis by the BLS highlights varied trends across different sectors. While the Health Care & Social Assistance and Government sectors maintained their lead in job creation, the Leisure and Hospitality industry saw a notable decrease in job growth. The Professional and Business Services industry, on the other hand, exhibited minimal growth, raising concerns about its future trajectory. These trends not only reflect the dynamic nature of the job market but also underscore the importance of sector-specific strategies to stimulate job growth and address challenges.

SSG’s Key Takeaways

As a recruitment firm, we’ve analyzed the recent BLS Employment Situation reports to offer insights for employers and job seekers as we head into 2024.

Job Seekers: The job market has shown consistent growth, with an average of 225,000 jobs added monthly in 2023. However, with a slowdown in growth towards the end of the year, it’s wise to prepare for a more moderate hiring pace. Opportunities are especially notable in healthcare, social assistance, and construction. With a low unemployment rate, competition for jobs is stiff, so it’s important to highlight your unique skills and consider roles in different sectors or locations.

Employers: The slowdown in job growth could lead to a larger pool of candidates, potentially easing the hiring process. This allows for more selective recruitment to find talent that best fits your company’s culture and needs. Despite a broader applicant base, it’s still vital to maintain an attractive employer brand and competitive benefits. Emphasize flexible work arrangements and consider candidates’ potential and broad skillsets, not just their past experience. Keep your compensation packages competitive to stand out in the evolving job market.

Both job seekers and employers should stay informed about economic trends and use data to guide their decisions. The job market is dynamic, and strategies should be adjusted according to the changing landscape.

Upcoming BLS Reports for the Fourth Quarter

The job market is in a constant state of flux, continually shaped by emerging trends and developments. The monthly Employment Situation Jobs Report provides an initial snapshot, but it only scratches the surface. Over the next few months, the Bureau of Labor Statistics will release a series of in-depth reports about the job market dynamics of the fourth quarter. Looking to stay informed and ahead of the curve? Pay close attention to these upcoming detailed analyses:

Thursday, January 19th – State Job Openings and Labor Turnover for November 2023

Tuesday, January 23rd – State Employment and Unemployment for December 2023

Tuesday, January 30th – Job Openings and Labor Turnover Survey for December 2023

Wednesday, January 31st – Employment Cost Index for Fourth Quarter 2023

Thursday, February 1st – Productivity and Cost for Fourth Quarter 2023

Wednesday, February 14th – State Job Openings and Labor Turnover for December 2023