The Latest on the Labor Market: November 2021

November 16, 2021

At this point, you’re all too familiar with the fact that shifts in the economy, combined with the lasting effects of COVID-19, have created challenges for businesses to attract, hire, and retain top workers. We are witnessing an unprecedented imbalance in labor availability compared to demand, giving workers more leverage to be selective in the roles they take. Earnings growth is at its highest levels in decades, and wages are rising, particularly for hourly workers, which is a trend we expect to continue in 2022.

“Higher wages for new hires are a must in the current job market, but many more existing workers will need to see pay raises as the starting point for sticking around, and many are expecting a pay bump in 2022.” (CNBC)

By the numbers, here’s the situation:

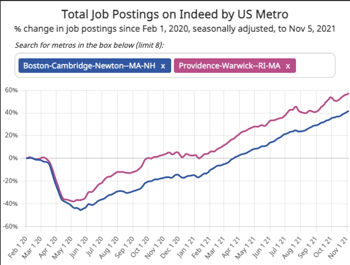

- Demand: On November 5, 2021, job postings on Indeed were 51.4% above where they were on February 1, 2020, which is considered the pre-pandemic baseline. (Indeed Hiring Lab)

- Supply: More than a year and a half into the pandemic, the U.S. is missing around 4.3 million workers, and many economists expect these to be permanent departures from the workforce. (WSJ) According to a recent study by Goldman Sachs, 1.5 million people left the workforce for early retirement while another 1 million left for “normal” retirement based on age. (Goldman Sachs)

- Turnover: Quit rates are at an all-time high of 2.9 percent as of August 2021. (Bureau of Labor Statistics)

- Wages: After wage growth lagging behind worker productivity for decades, the average hourly earnings are up 5.1% on the year. However, when accounting for inflation over the same period (see below), those gains are negated, meaning more increases will likely be necessary. (Washington Post)

- Inflation: As of October, consumer prices have surged 6.2% from a year ago, the most since December 1990. (CNBC)

Example Data by Region & Sector

We work with our clients to provide a range of information and data-backed recommendations related to compensation, brand positioning, recruitment process, and retention. Below we’ve provided example data for Boston and the Eastern Massachusetts region for construction positions. If you’re interested in this analysis for your business locations, we invite you to contact us at solutions@source2.com for a conversation and further details.

Job Postings:

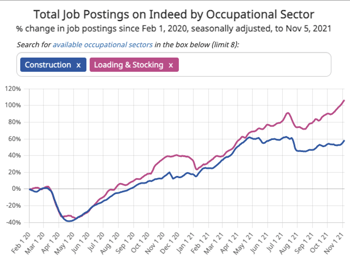

Eastern Mass: 41.8%, Rhode Island: 57.5%; Construction: 58.4%, Loading & Stocking: 106.5% (Indeed Hiring Lab)

Eastern Mass: 41.8%, Rhode Island: 57.5%; Construction: 58.4%, Loading & Stocking: 106.5% (Indeed Hiring Lab)

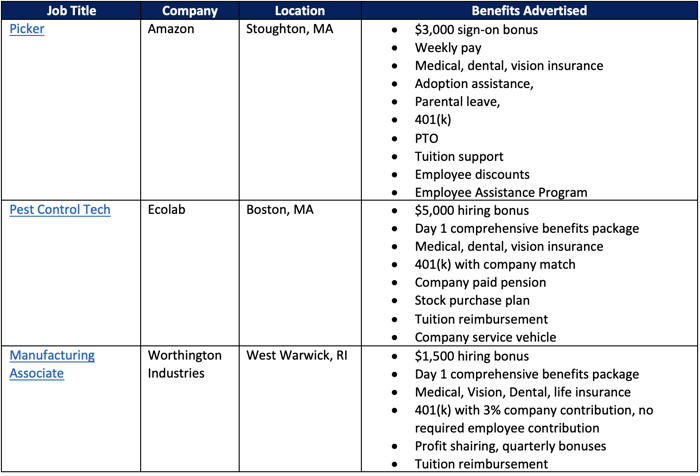

The share of job postings advertising hiring incentives (sign-on bonuses, retention bonuses, and cash incentives) has doubled since last July. Job searches for hiring incentives has increased 134% since the beginning of 2021. (Indeed Hiring Lab)

With more than 40% of employees currently searching for new roles, employers are offering higher salaries and raises, more flexible work schedules, and in-demand benefits like student loan assistance and early wage access. Without these benefits, employees now feel under-appreciated and under-compensated. (Benefit News)

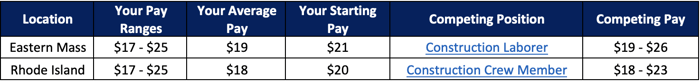

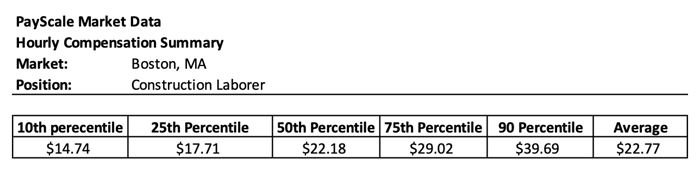

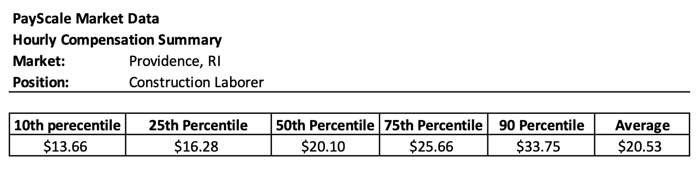

Competitive Pay Analysis by Position:

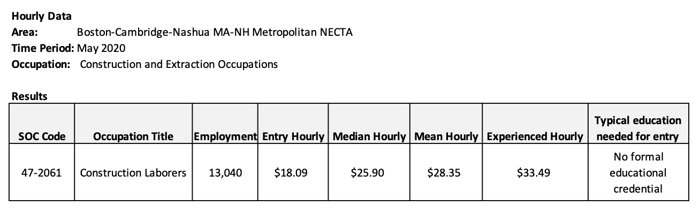

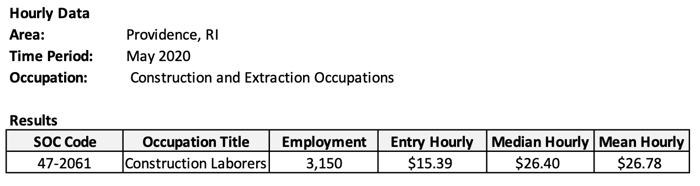

The annual Occupational Employment & Wages Report from the Massachusetts Department of Unemployment Assistance and the Bureau of Labor Statistics (released in April 2021) for the previous year outlines the current compensation market by industry.

The mean hourly wage for Construction Laborer occupations in the Boston MSA was reported at $28.35 per hour compared to the national average of $25.93 per hour.

Eastern Massachusetts Hourly Data:

Rhode Island Hourly Data:

For more information on how we partner with our clients, check out our website. If you would like to discuss your company’s specific situation and scaling solutions, connect with our executive team by emailing us at solutions@source2.com or by completing our contact form.

Written By: Source2

2757_7689.png?width=374&height=60&name=Source2_NoTag_Logo_(PRINT%2060px)2757_7689.png)