Semiconductor Industry Takeaways from the 2024 SEMI Industry Strategy Symposium

Each year, the SEMI Industry Strategy Symposium brings together leaders from around the globe to discuss the semiconductor industry’s performance, economic outlook, and strategies for achieving their goals. Damian Scandiffio and Derrick Ryskamp, Directors of Enterprise Sales for Acara Solutions, kicked off the new year hearing from industry experts and are sharing some of their biggest takeaways from the conference.

In a world increasingly reliant on newer, better, and faster technologies, demand for semiconductors – “the brains of modern electronics” – continues to rise. In fact, the semiconductor market worldwide is expected to grow by more than 20 percent in 2024 to a whopping $633 billion.

To keep up – and meet projections for hitting the trillion-dollar revenue mark by 2023 that experts are predicting – companies in the semiconductor industry must attract and retain a robust and highly qualified workforce while developing sustainable, diverse talent pipelines that will provide them with the resources they need for decades to come.

Beyond workforce challenges, semiconductor companies are also navigating new, increasingly complex technological needs, an evolving sustainability and energy landscape, supply chain troubles, as well as public policies and political tensions around the globe that directly impact their ability to operate.

The Economics of the Semiconductor Industry

Although the U.S. economy ended up performing better than expected in 2023, we heard predictions of slow economic growth in 2024. Inflation is still a serious concern, and interest rates will likely remain elevated. Experts expect flat economic growth in Europe, while China is projected to experience economic growth of 5 percent—although this could be a stretch.

At the same time, labor costs in the U.S. continue to increase at a rate of approximately 4 percent each year. This is higher than before the pandemic, when labor costs rose at a rate closer to 3 percent annually.

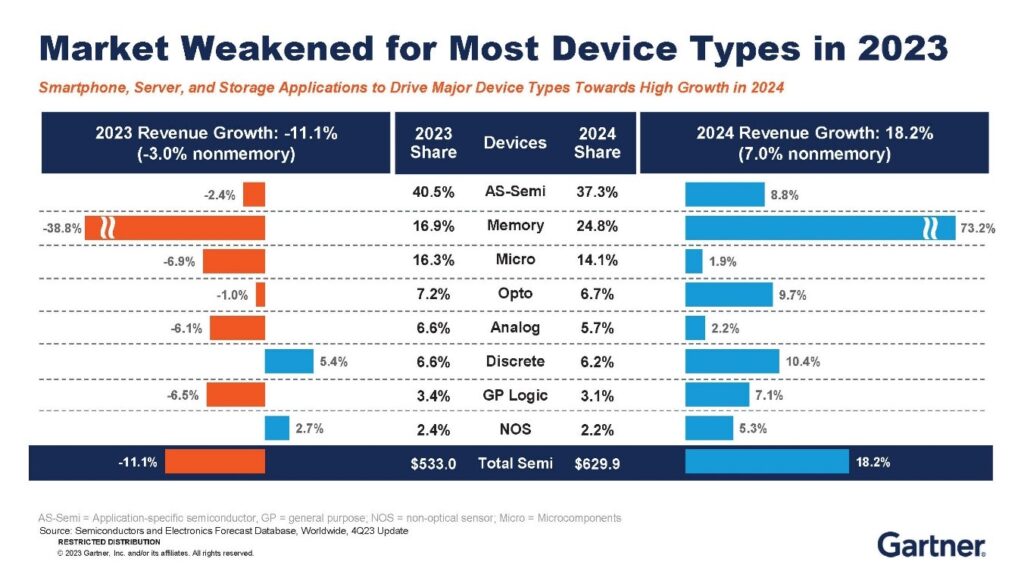

Of course, economic performance – good or bad – will have implications for the semiconductor industry. Experts say that semiconductor demand is in a “cyclical recovery,” and 2024 marks the start of a multiyear upcycle. Looking ahead, increased demand for semiconductors is largely being driven by high-performance computing, artificial intelligence, 5G phones and infrastructure, and automotive and industrial manufacturing and technologies.

(Source: Gartner)

Developing the Semiconductor Workforce of Tomorrow

So, where will the talent needed to support this growing demand come from? It was evident at the conference that finding and developing talent is one of the biggest obstacles the country needs to overcome to build up – and keep – semiconductor manufacturing in the U.S.

During a panel comprised of top industry executives, three out of four said that labor would be the largest obstacle facing the semiconductor industry in 2024. To address this problem, the industry must look at a variety of strategies that include:

- Cultivating engineering talent at the high school and collegiate levels through partnerships and STEM programs specifically designed to put students on career paths in the semiconductor space.

- Recognizing that design, engineering, and creative talent will still be needed, despite all the industry can and will be able to do with automation.

- Persuading higher-level talent to relocate to the smaller, more rural markets where semiconductor fabrication plants – or fabs – are being built.

- Taking a more global approach to talent acquisition that allows U.S. companies to better leverage talent from other countries.

Semiconductor Sustainability

The semiconductor industry is one of many that also faces mounting concerns related to energy and the environment.

Increased demand for manufacturing requires more energy—but where will this power come from, and who else will semiconductor companies need to compete with? Electrical power will become scarce as demand outpaces supply, initially on a local scale, and utility prices are sure to rise. Many fabrication plants and data centers have already found themselves competing with local communities for power and have been asked to either cease or limit production to prevent brownouts or blackouts in the surrounding areas. As a result, facilities are taking steps to become more self-sufficient, going so far as to develop their own wind and solar resources.

Looking ahead, the entire information communications and technology ecosystem – hardware, software, applications, architectures, and semiconductors – will need to make energy efficiency a priority. The industry is already exploring the use of chiplets in computing to lower power requirements, improve performance, and generate cost savings.

In the U.S., the Environmental Protection Agency (EPA) has begun to look more closely at fluoropolymers, also referred to PFAS, which will impact the semiconductor industry, as well. These products enable the manufacture of semiconductors and can be found in tanks, valves, pumps, and piping used to create the ultra-pure environments necessary for microchip manufacturing, per the American Chemistry Council.

Later this year, the Department of Energy will issue a report on the costs and benefits of fluoropolymers, along with their implications for various industries, including semiconductor. Some states are also enacting policies related to PFAS. The Maine legislature passed a bill requiring in-depth reporting requirements regarding PFAS use, and Minnesota went even further with an outright ban on the use of PFAS in specific products that will go into effect January 2025.

The industry is keeping a close watch on any policies further regulating PFAS, as they will likely affect semiconductor production and ultimately the many other industries that rely on semiconductor technology.

Stuck in the Middle: The Politics of Semiconductors

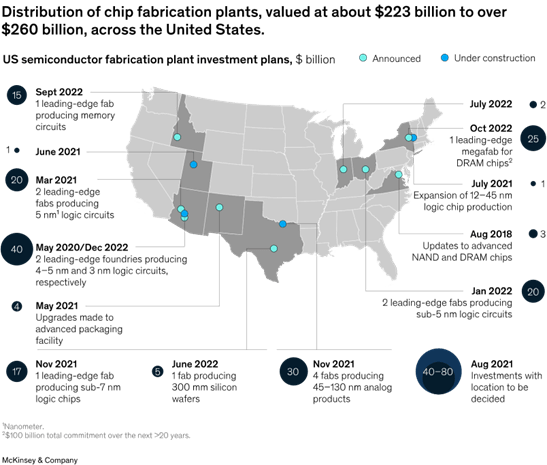

Semiconductors have found themselves at the center of rising tensions between the U.S. and China, which has been a catalyst for a nationwide push to bolster domestic semiconductor manufacturing in recent years.

Experts predict that the Biden administration will continue to restrict China’s access to U.S. technology, data, and capital – adding more pressure to an already stressed global technology supply chain. Semiconductors, AI, and quantum computing will be most affected, with biotechnology, critical minerals, and the battery sector also encountering new challenges.

Meanwhile, China will likely respond by further developing its independent semiconductor capabilities, leading to dramatic geographic shift in the worldwide semiconductor industry by the end of the next decade, according to Gartner.

In 2022, the U.S. passed landmark legislation – the CHIPS Act – to boost investments in domestic semiconductor manufacturing, research and development, and technical skills. But there is some fine print. Perhaps not surprisingly, the legislation prohibits funding recipients from significantly expanding semiconductor manufacturing capacity in China for 10 years. Expanded capacity is linked to the addition of a cleanroom or physical space, with material expansions defined as increasing production capacity by more than 5 percent. Funding recipients are also prohibited from introducing new cleanroom space or production lines that exceed a facility’s production capacity by more than 10 percent.

Lastly, the bill includes limitations on joint research or technology licensing with foreign entities of concern, with exceptions for international standards, patent licensing, and utilization of foundry and packaging services.

Opportunities in the States

Several states are investing heavily in the semiconductor industry, while others have launched initiatives that could greatly benefit companies that directly and indirectly support production and manufacturing.

- Texas passed its own CHIPS Act to establish an Innovation Consortium and Innovation Fund with $398 million in appropriations.

- The Arizona Commerce Authority convened a Semiconductor Task Force that’s providing $100 million in initial state-backed infrastructure funding.

- Oregon has $190 million in funding to leverage the resources coming to the state through the federal CHIPS legislation.

- The California Competes Tax Credit program gives businesses in any industry the opportunity to compete for significant tax credits.

- New York’s “Green CHIPS Program” offers up to 5 percent of project capital expenditures and up to 8 percent of R&D expenditures as tax credits.

- The State of Michigan is supporting SEMI’s workforce initiatives and has rolled out several infrastructure, tax, workforce, and R&D incentives in recent years.

(Source: McKinsey & Company)

Summary

Semiconductors are critical to our everyday lives and our economic growth here in the U.S. and around the world. Demand for semiconductors is on an upward trajectory, but the industry is certainly not without its challenges – and workforce development is one of the most urgent.

To address these obstacles as effectively as possible, the industry will need to partner with organizations that have a track record in managing and executing high-volume workforce programs and are well equipped to deliver creative talent development solutions that combine community involvement, educational awareness, and innovative marketing strategies to stand out in a difficult labor market.

Acara Solutions and Broadleaf Results bring years of experience delivering talent acquisition solutions to clients in the semiconductor industry, and we’re ready to help you meet your hiring goals in 2024 and beyond. Schedule some time on my calendar to learn more.

This blog was written by Damian Scandiffio.