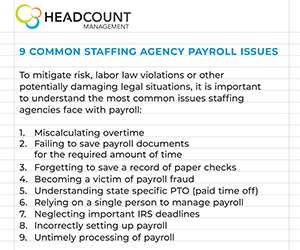

9 Common Payroll Mistakes And How to Avoid Them? – CuteHR

CuteHR

FEBRUARY 10, 2022

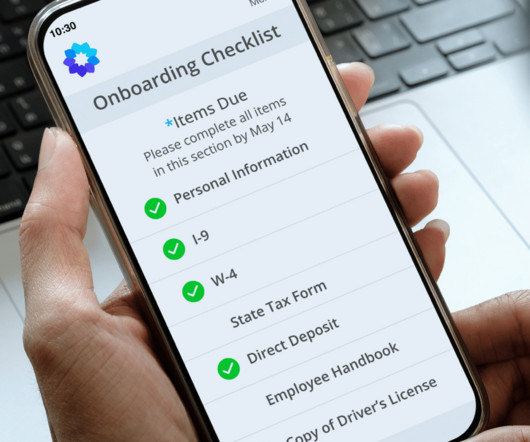

It is estimated that 82 million Americans – 54% of the workforce – face payroll problems. When it comes to payroll, employers have a lot of duties. Payroll mistakes can have far-reaching ramifications. Thankfully the payroll mistakes can be categorized into the following categories.

Let's personalize your content