Impact of Form W-4 on Federal Income Tax Calculations

Namely - Talent

MARCH 5, 2021

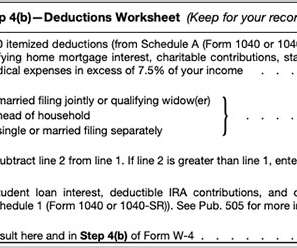

It has been two years since congress and the IRS have overhauled the tax code. The Tax Cut and Jobs Act (TCJA) created changes in the tax code that impacted personal income taxes and created a new Form W-4.

Let's personalize your content